dallas texas local sales tax rate

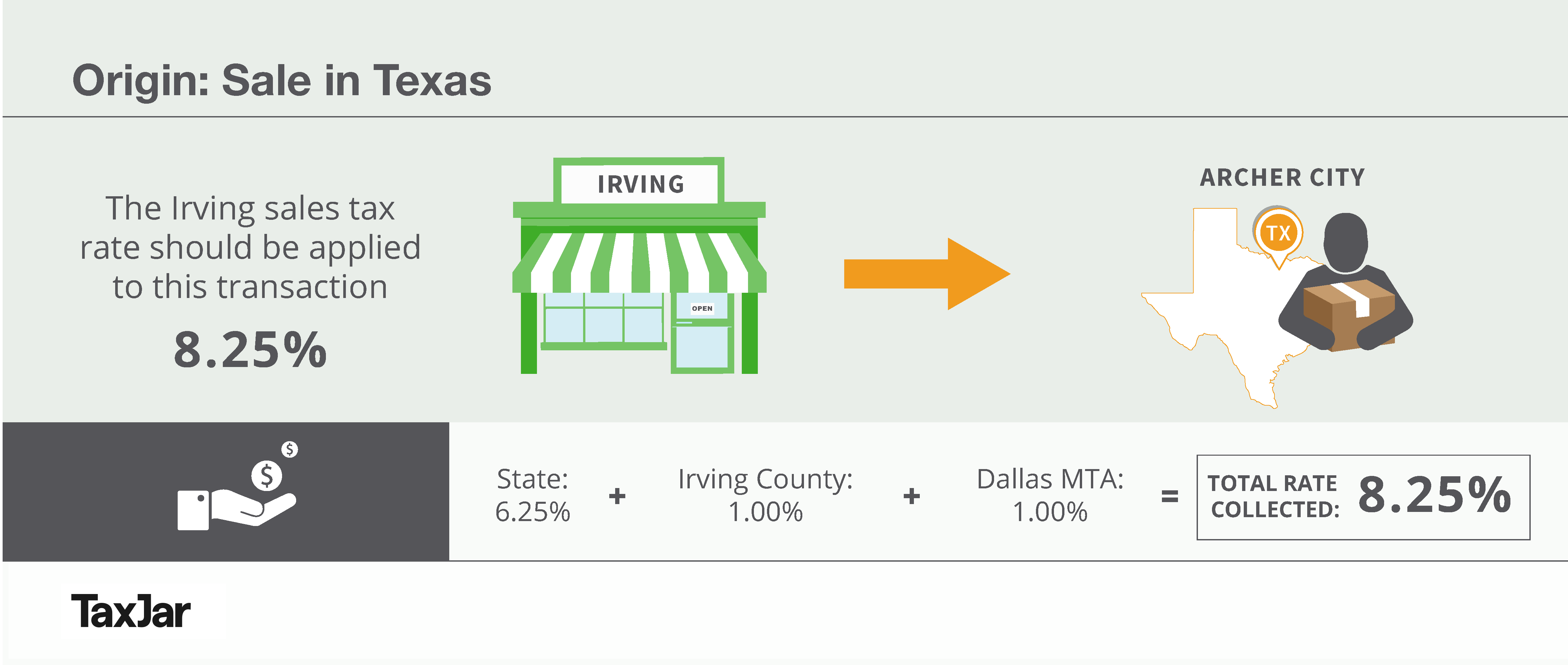

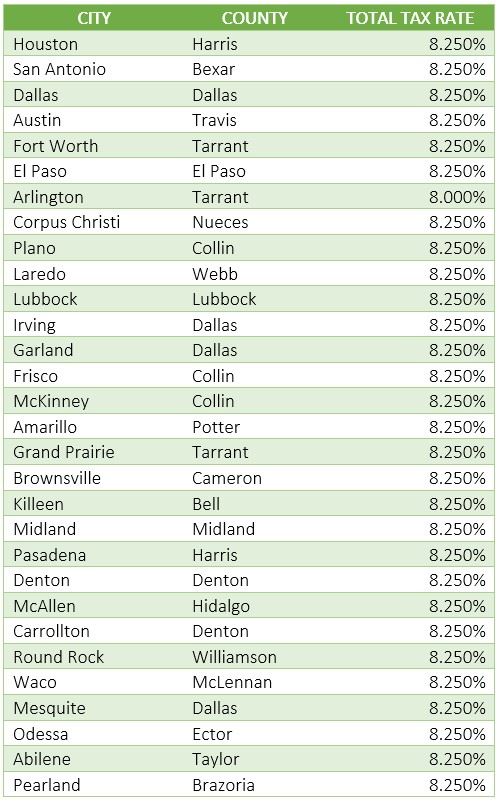

The Dallas Texas sales tax is 625 the same as the Texas state sales tax. The Texas state sales and use tax rate is 625 percent but local taxing jurisdictions cities counties special-purpose districts and transit authorities also may impose sales and use tax up to 2 percent for a total maximum combined rate of 825 percent.

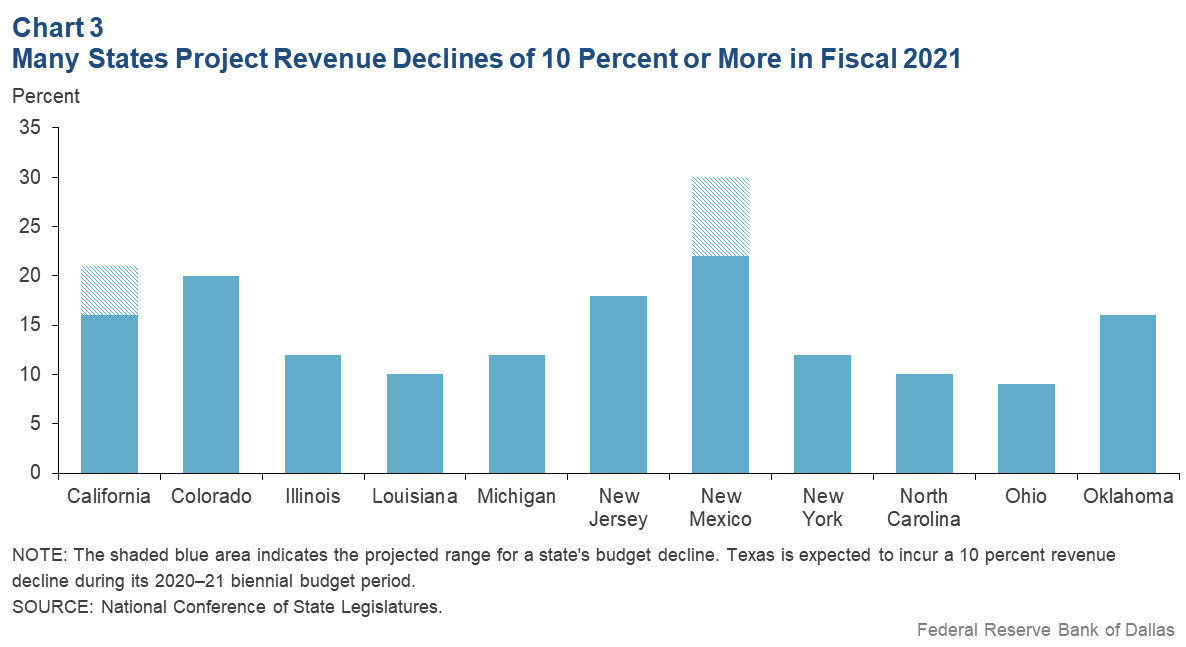

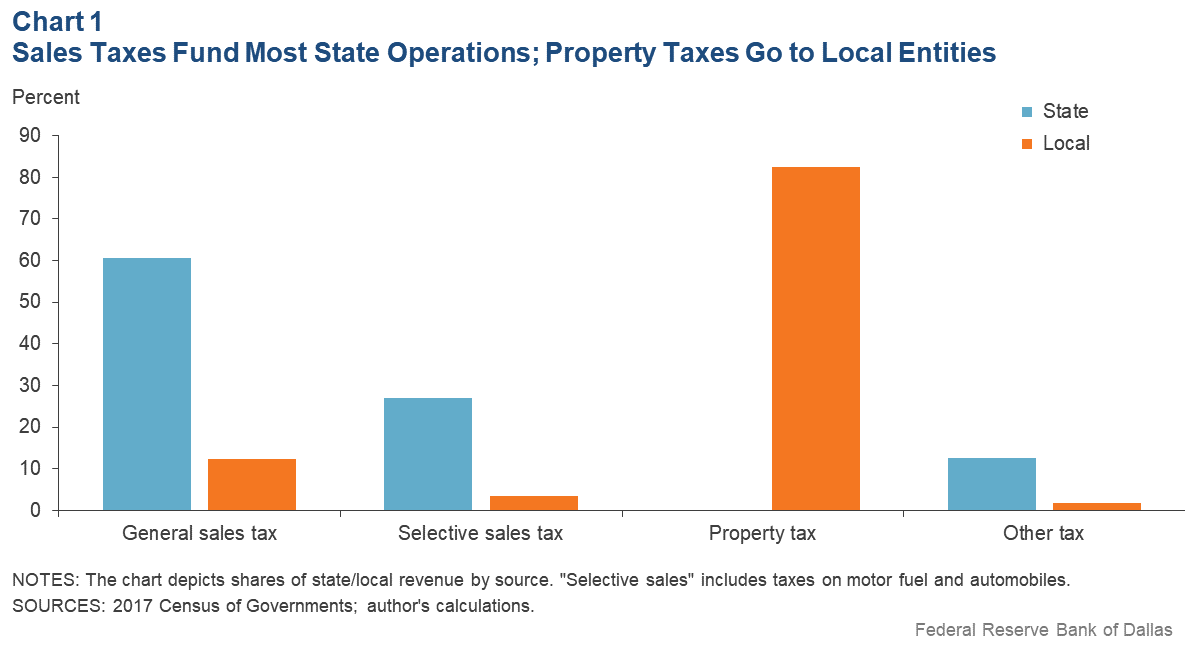

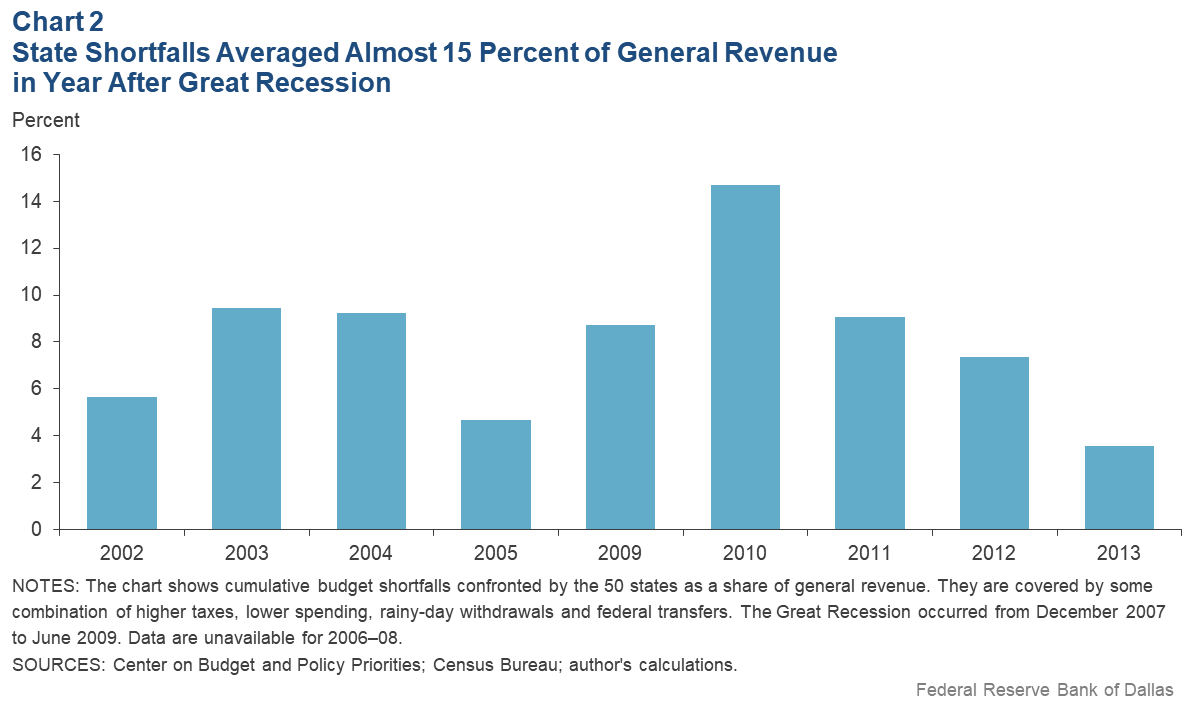

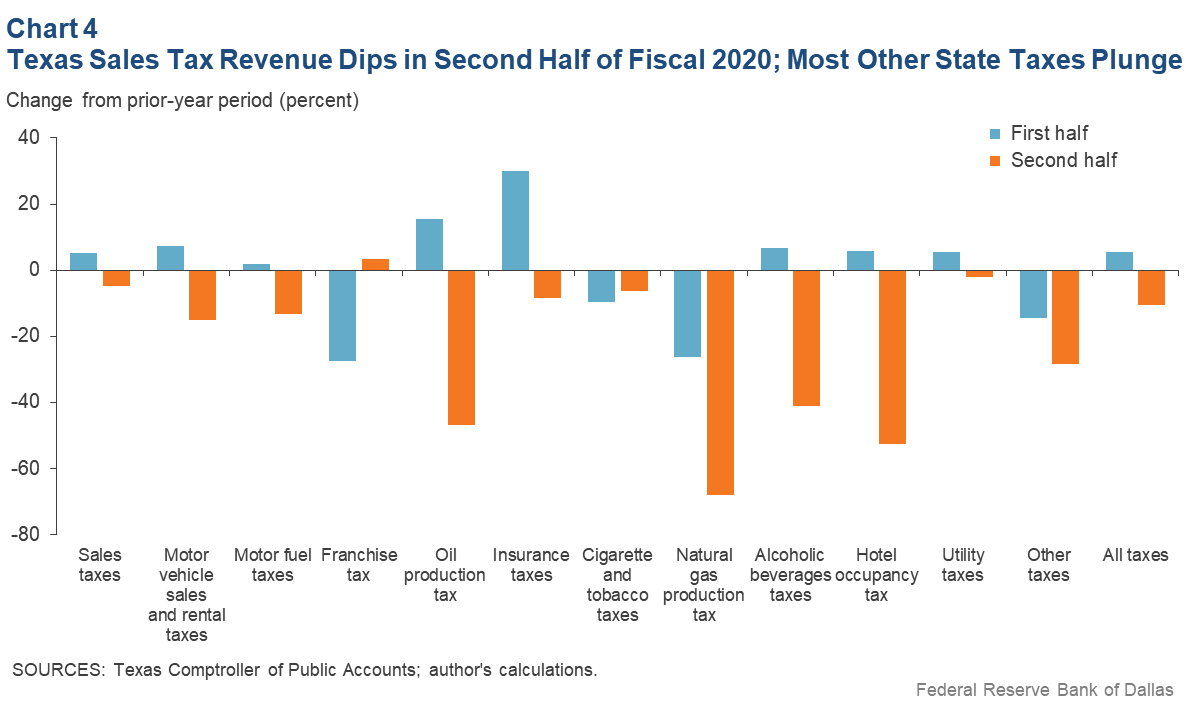

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 825.

. To make matters worse rates in most major cities reach this limit. Rate histories for cities who have elected to impose an additional tax for property tax relief Economic and Industrial Development Section 4A4B Sports and Community. There are a total of 998 local tax jurisdictions across the state collecting an average local tax of 1684.

The current total local sales tax rate in Lake Dallas TX is 8250. You will be required to collect both state and local sales and use taxes. Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services.

4 rows Dallas. While Texas statewide sales tax rate is a relatively modest 625 total sales taxes including county and city taxes of up to 825 are levied. The County sales tax rate is 0.

The Dallas Sales Tax is collected by the merchant on all qualifying sales made within Dallas. The local sales and use tax rate history shows the current and prior sales tax rates imposed by a local jurisdiction along with the effective date and end date of each tax. To review the rules in.

TEXAS SALES AND USE TAX RATES July 2022. AddisonDallas Co 2057217 010000 082500 Allentown 067500. This is the total of state county and city sales tax rates.

TEXAS SALES AND USE TAX RATES July 2022. The 825 sales tax rate in Dallas. Texas Comptroller of Public Accounts.

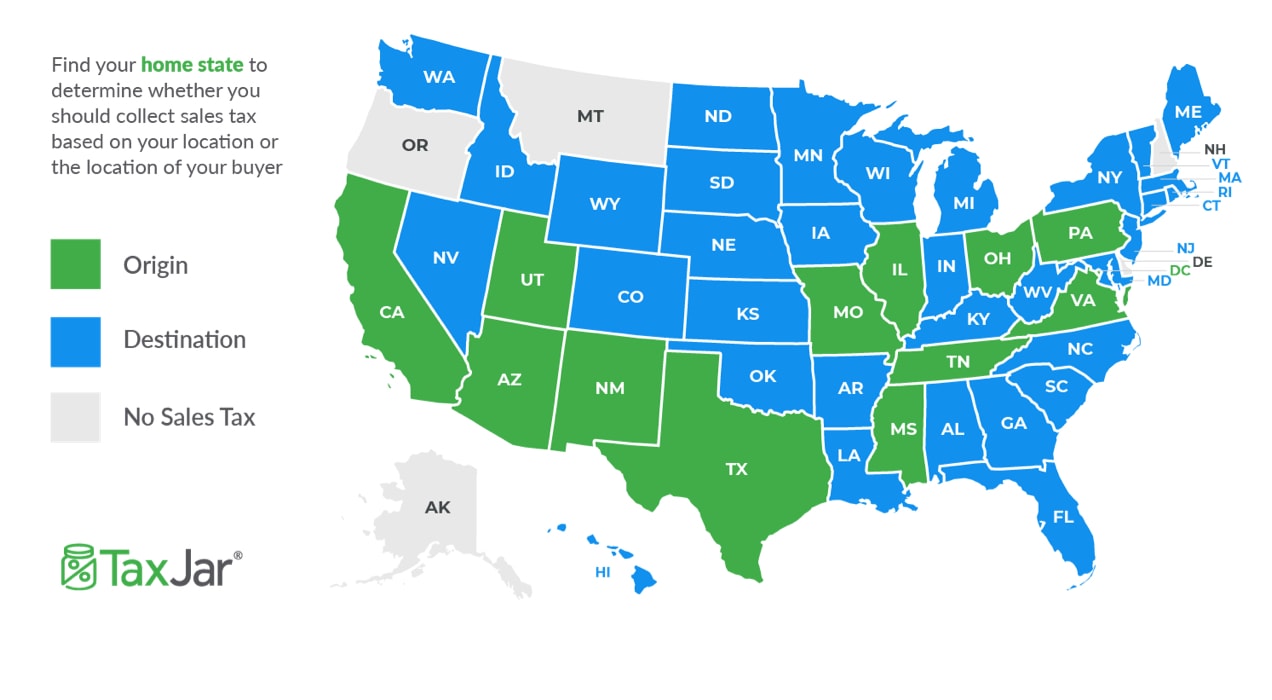

Learn how Avalara can help your business with sales tax compliance today. While many other states allow counties and other localities to collect a local option sales tax Texas does not permit local sales taxes to be collected. The 2018 United States Supreme Court decision in South Dakota v.

The Dallas County sales tax rate is. Average Sales Tax With Local. This is the total of state county and city sales tax rates.

The minimum combined 2022 sales tax rate for Dallas Texas is 825. How much are taxes in Dallas Texas. The Texas state sales tax rate is currently.

214 653-7811 Fax. The Texas sales tax rate is currently 625. The Texas state sales tax rate is 625 and the average TX sales tax after local surtaxes is 805.

Has impacted many state nexus laws and sales tax collection requirements. Local taxing jurisdictions cities counties special purpose districts and transit authorities can also impose up to 2 percent sales and use tax for a maximum combined rate of 825 percent. Adkins Bexar Co 082500.

What is the sales tax rate in Dallas Texas. Ad Solutions to help your business manage the sales tax compliance journey. Local Code Local Rate Total Rate.

The County sales tax rate is. Denton TX Sales Tax Rate. The Lake Dallas sales tax rate is.

4 rows Dallas collects the maximum legal local sales tax. The minimum combined 2022 sales tax rate for Lake Dallas Texas is. While many counties do levy a countywide sales.

City sales and use tax codes and rates. Groceries prescription drugs and non-prescription drugs are exempt from the Texas sales tax. Dallas TX Sales Tax Rate.

The Texas sales tax rate is currently. The Dallas Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 Dallas local sales taxesThe local sales tax consists of a 100 city sales tax and a 100 special district sales tax used to fund transportation districts local attractions etc. 34 rows Dallas County Has No County-Level Sales Tax.

Dallas Houston and San Antonio all have combined state and local sales tax rates of 825 for example. TX Sales Tax Rate. Texas has state sales tax of 625 and allows local governments to collect a local option sales tax of up to 2.

The December 2020 total local sales tax rate was also 8250. The current total local sales tax rate in Dallas TX is. Name Local Code Local Rate TotalRate Name Local Code Local Rate TotalRate Ames 2146096 010000 077500 AransasPass San Patricio Co 2205012 010000 082500.

The current total local sales tax rate in Dallas County TX is 6250.

How To Charge Your Customers The Correct Sales Tax Rates

2021 2022 Tax Information Euless Tx

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

How To File And Pay Sales Tax In Texas Taxvalet

How To Charge Your Customers The Correct Sales Tax Rates

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

The Seller S Guide To Ecommerce Sales Tax Taxjar Developers

How To Charge Your Customers The Correct Sales Tax Rates

Texas Sales Tax Rates By City County 2022

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

15 States With No Income Tax Or Very Low Which States Can Save You The Most Bhgre Homecity

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

Texas Sales Tax Guide For Businesses

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

Why Are Texas Property Taxes So High Home Tax Solutions

What Is Georgia S Sales Tax Discover The Georgia Sales Tax Rate For 159 Counties

How To File And Pay Sales Tax In Texas Taxvalet

How Taxes In Texas Compare To Other States Guide To Texas Property Tax Comparison Tax Ease